Current State & Development Prospects of the Injection Molding Machine Industry

As a key piece of equipment in the plastics processing industry, the injection molding machine plays an indispensable role in global manufacturing. Its importance is particularly prominent in China, a major player in both the production and consumption of injection molding machines. With the growing global demand for plastic products, the injection molding machine industry is experiencing unprecedented development opportunities. This article will delve into the classification, industry chain, market size, and competitive landscape of injection molding machines, providing a comprehensive analysis of the industry’s current state and future prospects.

Overview of Injection Molding Machines

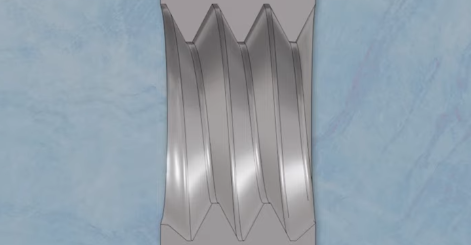

The injection molding machine, also known as a plastic injection molding machine, is a primary piece of equipment for molding thermoplastic or thermosetting plastics into various shapes using plastic molding molds. Typically composed of injection systems, hydraulic systems, electrical control systems, and mechanical systems, injection molding machines heat plastic to a molten state and inject it into the mold cavity under high pressure, where it cools to form a shaped product. The efficient operation of injection molding machines depends on the precise coordination of these systems, making it an essential piece of equipment in modern manufacturing.

Classification of Injection Molding Machines

Injection molding machines can be classified based on their drive mechanisms into hydraulic injection molding machines, all-electric injection molding machines, and hybrid injection molding machines. Each type has its unique advantages and applicable fields.

| Classification | Characteristics |

| Hydraulic Injection Molding Machine | Features high clamping force, extended mold clamping, and holding time, making it suitable for the production of large plastic products. |

| All-Electric Injection Molding Machine | Offers stable injection performance, precise and fast control, high production efficiency, low pollution, and noise, making it ideal for medium to small-sized high-speed precision molding. |

| Hybrid Injection Molding Machine | Combines the characteristics of both hydraulic and all-electric machines, offering high clamping force and injection pressure, precise control, fast operation, complete functionality, and moderate cost. |

Hydraulic injection molding machines are favored for their strong clamping force and prolonged mold clamping and holding capabilities, making them the top choice for producing large plastic products. On the other hand, all-electric injection molding machines, with their efficient, eco-friendly, and low-noise features, are particularly suitable for producing medium to small-sized precision plastic products. Hybrid machines, blending the benefits of both types, provide a broader range of applications and perform well in cost control.

The Industry Chain of Injection Molding Machines

The industry chain of the injection molding machine sector includes upstream raw materials like steel, pig iron, castings, and key components such as drive systems and electrical control systems. The midstream segment consists of injection molding machine manufacturers, while downstream comprises the end-users of the injection molding machines, including the automotive industry, household appliances, the medical industry, packaging, and beverages.

| Industry Chain Position | Content |

| Upstream | Raw Materials: Steel, Pig Iron, Castings, etc.Components: Drive Systems, Electrical Control Systems, etc. |

| Midstream | Injection Molding Machine Manufacturers |

| Downstream | Household Appliance IndustryAutomotive IndustryMedical Industry, etc. |

In the injection molding machine industry chain, the supply of upstream raw materials and components directly impacts the production cost and product quality of the entire industry. Midstream manufacturers process and assemble these raw materials and components into high-performance injection molding machines. The downstream users span a wide range of industries, with the automotive and household appliance industries being the major application areas.

Market Size of the Injection Molding Machine Industry

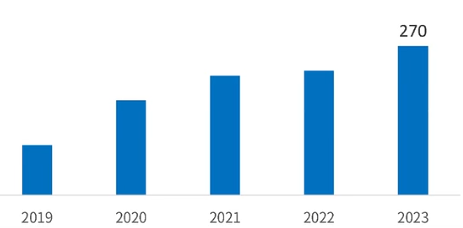

As a crucial piece of equipment in the plastics processing industry, the market size of injection molding machines is closely tied to the development of global manufacturing. China, as a leading producer and consumer of injection molding machines globally, occupies an important position in the world market. In 2023, China’s injection molding machine market size was approximately 27 billion RMB, accounting for about 30% of the global market.

With the continuous development of global manufacturing, the demand for injection molding machines is steadily increasing. Particularly in China, with the acceleration of industrialization and ongoing technological advancements, the market size of injection molding machines is expanding year by year. China is not only one of the world’s largest production bases for injection molding machines but also one of the major consumer markets globally, providing broad development space for both domestic and international manufacturers.

Competitive Landscape of the Injection Molding Machine Industry

The global injection molding machine industry can be divided into three tiers. The first tier includes European and Japanese companies like Engel and Fanuc, which dominate the high-end market; the second tier consists of domestic leaders such as Haitian International and Yizumi, which are positioned in the mid-market and are moving towards the high-end market; the third tier is made up of numerous small and medium-sized domestic enterprises that occupy the low to mid-end market.

| Competitive Tier | Representative Companies |

| First Tier | Engel, Fanuc |

| Second Tier | Haitian International, Yizumi |

| Third Tier | Numerous Small and Medium-Sized Domestic Enterprises |

Currently, although domestic injection molding machines occupy a significant share of the low to mid-end market, there remains a gap between domestic brands and foreign brands in the high-end market. This is mainly due to the reliance on imported core components. Japanese brands excel in all-electric injection molding machines, while European brands are known for superior performance in hydraulic machines. As domestic companies continue to improve their technology, it is expected that Chinese injection molding machines will play an increasingly important role in the global market.